Save $300!

Pre-Order the 2024 HCP Benchmarking Report Now

Participate Now in HCP’s 15th Annual Benchmarking Report!

For a limited time, you can secure your copy of the industry’s most trusted study on home care, home health, and hospice and save $300. Pre-order your 2024 HCP Benchmarking Report now and get it at a special reduced price. This offer expires soon, so hit the button below to take advantage of it today!

What’s included?

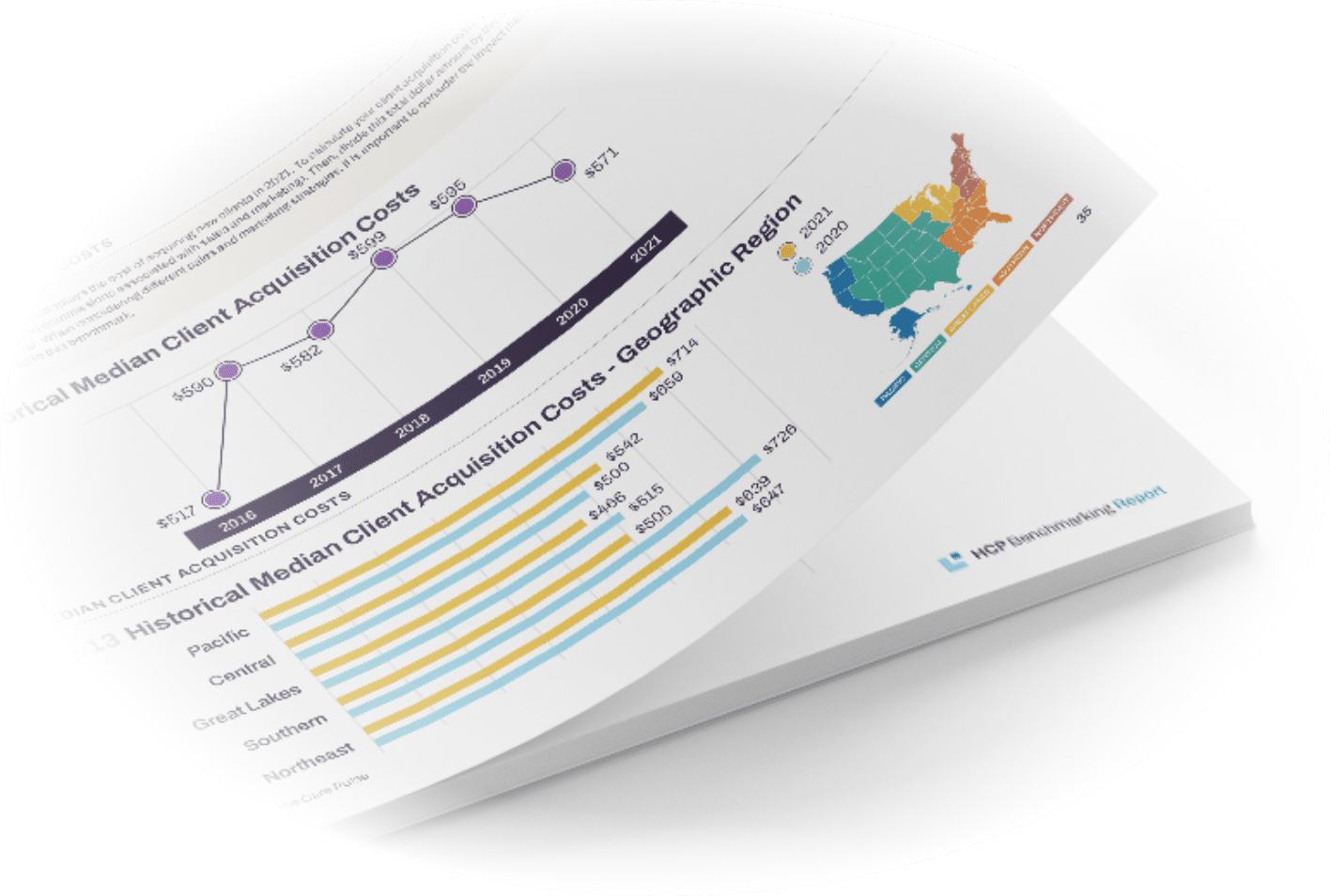

The HCP Benchmarking Report features insights and benchmarks with comparisons by demographics such as geographic region, revenue range, years in business, and population served.

Industry Specific Trends

Keep up to date with trends in recruitment, turnover, marketing, finance, sales—it’s all here.

Recruitment & Retention

Stack the recruitment and retention odds in your favor by making more informed, strategic, data-backed decisions.

Finance

See how you stack up to the competition from a financial perspective.

Customer Experience

Boost satisfaction scores by discovering what tens of thousands of customers like and dislike about their care experience.

Operations

Get a roadmap to operational success with in-depth intel on crucial client/patient metrics, including turnover rates, lifetime value, and more.

Sales & Marketing

Elevate sales and marketing performance by seeing hard data on what works and what doesn’t for agencies nationwide.

Technology

Get ahead of the curve by understanding how agencies are leveraging technology to grow and solve problems.

Training

Improve care, carve a niche, and build a career ladder for your staff with access to usage data on specialty training topics, training methods, and the most popular training providers.

Why Benchmarking Matters

Post-acute care is one of the fastest growing industries in the country and is projected to continue along an upward trajectory. Being equipped to not only grow with it, but emerge as a leader, requires more than intuition. Having sufficient, accurate, actionable data to benchmark against shows you where you are now and how to get to where you want to be.

Here’s what others in the industry have to say…

“When I started my company, one of the best things I did was sign up to provide information to the Benchmark Study. Over the years, I continually referred back to these studies to compare my growth to companies the same size as mine. I’ve learned a tremendous amount by submitting my data which in return, gives me a wealth of data about our industry.”

“What can I say about the HCP Benchmarking Report, except that it’s the best tool you can have to measure year to year growth. It is vital that all business owners know what are the best practices, the metrics, the margins, and more of other businesses in the same field. Measuring your internal performance against industry standards helps you to know your strengths and weaknesses. This will allow you to make decisions on how to properly scale your business by leaps and bounds in a relatively short period of time. Simply put, HCP and the information provided, is an essential tool for every home care agency year in and year out.”

“HCP’s Benchmarking Report is a tremendously vital tool for collecting agency-level data and examining the home care industry’s ever-evolving and growing footprint. With its comprehensive analysis of recruitment and retention data, sales and marketing findings, financial insights, the latest trends, and more, every home care provider would be wise to participate year after year.”

“I always say, “What gets measured gets managed, what gets rewarded gets repeated.” The best way to understand how to measure the performance of your company is to participate in the annual Benchmarking Report from HCP. Download the preparation worksheet, gather your own data, and submit your data. Then purchase a copy of the report and study the results. Use it every day to compare your company to the industry. I have supported the annual Benchmarking Study for over a decade. I never go into the office of a home care strategy client without my copy of the benchmarking report. It is THE source for facts and data about our industry.”

“Every home care agency should participate in the Benchmarking Study, and every home care agency should use the Benchmarking Study.”